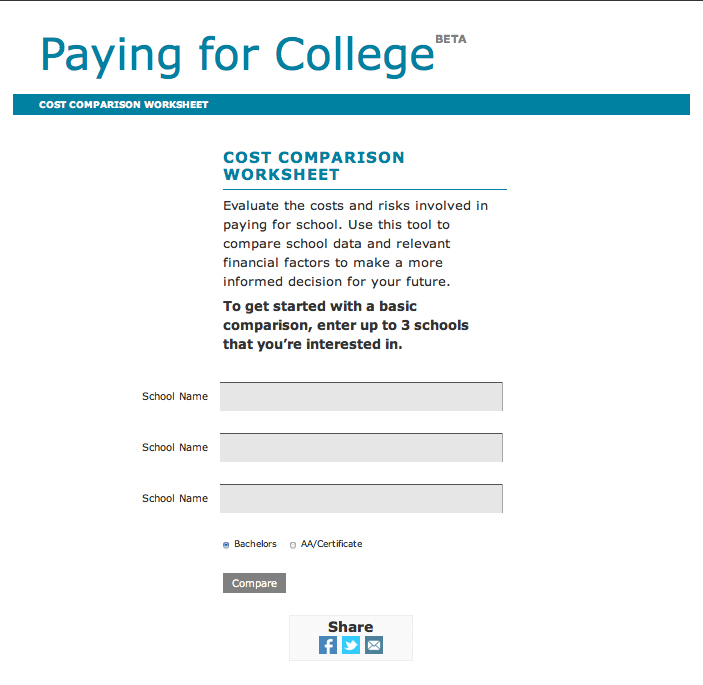

The Consumer Financial Protection Bureau has unveiled a new online tool for college students, or prospective college students, to compare and calculate the monthly costs and resulting debt they would incur from different schools.

The website, which has been in the works since 2010, helps students compare their college finances in respect to 7,500 of the country’s most popular institutions, allowing students to insert up to three schools at a time.

Dennis Chavez, director of financial aid at Binghamton University, said that student loan debt is becoming a more pressing issue for students across the nation, as tuition consistently increases. He considers it a valuable tool for students to come to understand the consequences of their financial situations.

“Costs for college education continues to be a problem because federal aid has remained relatively flat … student debt is now more on the mind of students as they become more dependent on student loans,” Chavez said.

Loans are the primary source of financial aid at Binghamton, although those who qualify for need-based aid are eligible to receive grants and scholarships as well, according to Chavez.

The average amount borrowed to attend public universities is $15,697, while the average amount borrowed to attend private universities is $26,694, according to the CFPB’s website.

Stephanie Sheintul, a freshman double-majoring in philosophy and philosophy, politics and law, said she considered financial aid when deciding where to go to college.

“My mom calculated the debt before I decided to come here, but it was more like a guesstimate,” Sheintul said. “If I had known about a tool like this that the government was sponsoring I would have definitely used it and approve of it now for future students, I wish I had it though!”

Corinne Healey, a sophomore majoring in environmental studies, said she did not need the calculator to know Binghamton is a deal.

“It wasn’t really worth it, calculating the debt for this school, because the price doesn’t come close to the others,” Healey said.

The type of financial aid available for an individual can change depending on the school’s financial policies. The new debt comparison website allows students to input their information to see how the outcomes would alter with their financial aid award. The website provides an average debt calculator in the absence of one’s personal information, which may skew the debt higher or lower than may be the case for the individual.

Chavez said that when it comes time to pay the semester bill, students frequently visit the financial aid office to affirm that their aid has been processed, and ask questions on how the process works.

“Because they only do this once a year, even returning students are not always sure, but this is not necessarily a bad thing because we want them to focus on their education, and we’re here to help walk them through the process when the time comes, whether new students or returning,” Chavez said.

Alex Garib, an undeclared freshman, said he prefers not to worry about the debt now.

“I’m not thinking about the debt yet, but I know it will hit once I’m closer to graduation,” Garib said.

Timothy Campbell, a junior majoring in psychology, has started to contemplate his loans.

“Yeah, I think debt is a problem, mostly because I’m going to be in debt for the rest of my life, but I plan to just be in school for as long as possible,” Campbell said.