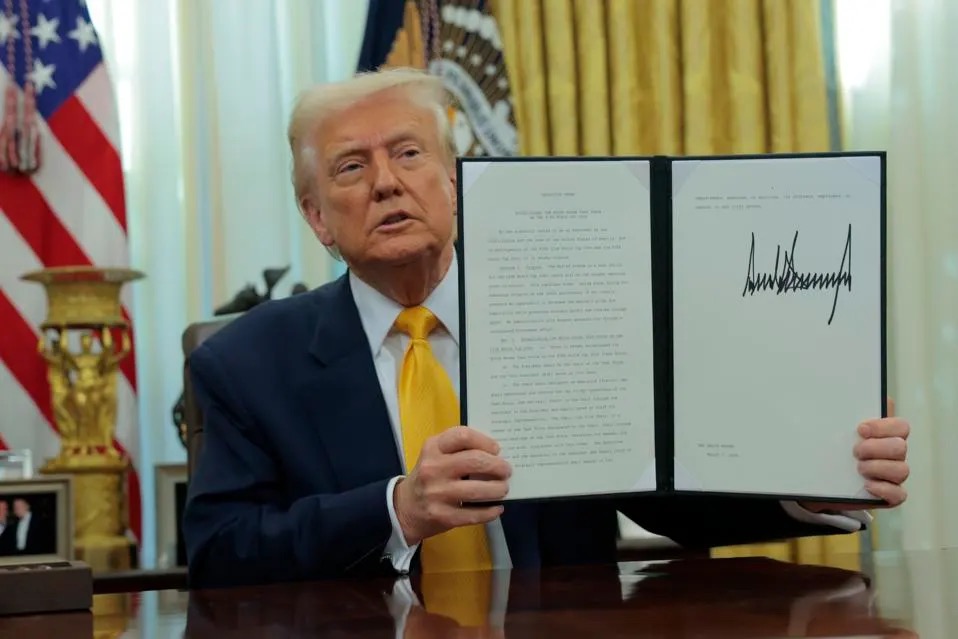

President Donald Trump issued an executive order earlier this month proposing limits on who can apply for federal student loan forgiveness. The order follows bureaucratic changes to the federal government that may impact financial aid and student loans.

Titled “Restoring Public Service Loan Forgiveness,” the order said that the Biden administration abused the Public Service Loan Forgiveness program, which has traditionally forgiven student debt of public service workers after a decade of service and minimum payments. It said the program has been used to fund “activist organizations” that “harm our national security and American values, sometimes through criminal means.”

It recommends that individuals employed by such organizations be excluded from program eligibility.

“As President of the United States, I have a duty to protect, preserve, and defend the Constitution and our national security, which includes ending the subsidization of illegal activities, including illegal immigration, human smuggling, child trafficking, pervasive damage to public property, and disruption of the public order, which threaten the security and stability of the United States,” the order read.

The executive order described organizational actions that have “a substantial illegal purpose,” including violating immigration law, supporting terrorism, engaging in “child abuse,” like supporting gender-affirming care for minors, violating civil laws like trespassing, disorderly conduct and public nuisance, and engaging in discrimination.

While no specific organizations were named, critics said the order could target advocacy organizations for supporting causes opposed by the Trump administration rather than legitimate illegal activity.

Following the executive order, the administration laid off about 50 percent of the Department of Education’s staff, with nearly a quarter of employees in the Office of Student Aid having already been laid off. The layoffs follow Trump’s reported plans to dismantle the department, which must be done through congressional action.

“We’re going to move the Department of Education,” Trump said in a press conference last week. “We’re going to move education into the states, so that the states — instead of bureaucrats working in Washington — can run education.”

The administration also removed application materials for income-based student loan relief, only some of which were blocked by federal courts.

Former President Joe Biden attempted to implement a wide-ranging loan forgiveness plan during his presidency, citing a 2003 law allowing the government to relieve student loan obligations during a “national emergency.” The plan, which would have permitted around 43 million Americans to cancel up to $20,000 in debt, was struck down by the U.S. Supreme Court in 2023. The Biden administration still canceled $183.6 billion in student loan debt through other legal mechanisms.

Trump’s recent policies have created uncertainty for borrowers and students looking to take out loans. Amber Stallman, the director of financial aid at Binghamton University, said the executive order was “not related to the administration of federal financial aid for students,” but could impact borrowers.

She mentioned federal financial aid programs that BU students regularly use. Students receiving Pell Grants and Federal Supplemental Educational Opportunity Grants do not need to pay back the financial assistance, which comes directly from the federal government. Federal Work-Study is available based on need.

The University is a recipient of the Federal Direct Loan Program, offering low-interest loans for both undergraduate and graduate students. Undergraduate students can receive need-based subsidized loans, where interest is paid by the federal government while enrolled, and no interest is charged for six months after graduation. Unsubsidized loans are available to undergraduate students enrolled in at least six credits and graduate students taking at least three.

“Our job is ensuring federal funds are distributed fairly and follow all the rules,” Stallman wrote. “Federal financial aid is a huge part of making college affordable for many students here, and we’re always looking for ways to help students make the most of these resources.”